2.10. Margin Trading – Leverage – Stop or Cut Loss.

This section is very important. I’m sure that you will never get this from other books or resources; and I’m also sure that nobody has ever thought you this before. Read this section over and over again until you fully understand.

Leverage is the number one killer of 95% traders. But a lot of people even don’t know what leverage or margin trading is. A lot of traders do not know that they have the freedom not to use leverage at all, and actually they can set their own leverage level by themselves.

Please read and repeat this many times over. This is very important. Since I invented it, I would like to call it whenry’s law of trading leverage (pronounced double u Henry). This is my legacy for you all, I will make history and be famous guys 😉

This is the fact; you can not run from it. If you trade Forex, indexes, or futures, the only way not to lose money is not to use any leverage and stop loss at all.

The problem if you use no leverage at all is that you will get a low return. If I use my trading system without leverage at all, on average I can get 5-10% ROI a year.

Risk tolerance is subjective to every trader. Some traders have a high tolerance of risk and some prefer low risk. You can set your own risk level by setting your leverage.

Always remember that:

You need to find the balance between risk and profit return according to your risk tolerance.

The most important thing is:

OK, let’s get technical. Let me show you what leverage is, how many types of leverage are there, how to calculate true leverage and how to use proper leverage.

According to Investopedia (http://www.investopedia.com/terms/l/leverage.asp) leverage is:

“1. The use of various financial instruments or borrowed capital, such as margin, to increase the potential return of an investment.”

”2. The amount of debt used to finance a firm’s assets. A firm with significantly more debt than equity is considered to be highly leveraged.”

I would like to make it simple: Leverage is “to get more with the same effort or less”.

In my opinion, there are three kinds of leverage:

- Broker Leverage.

- True Leverage.

- Proper Leverage.

When you first open a trading account, your broker will offer you what leverage you want to use; 1:50, 1:100, 1:500, or even 1:1000. I’d like to call this “Broker Leverage”. Broker leverage is different from your actual leverage when you trade. I’d like to call your actual leverage “True Leverage”.

- Broker Leverage.

Broker leverage represents margin level percentage that you have to maintain before you are subject to margin call. Margin is the amount of necessary money needed to place/maintain a position. Most brokers will ask you to maintain at least 100% margin level, below this point you will get a margin call. When a margin call occurs, all open positions are subject to liquidation at the prevailing market prices without prior notice to customer.

The formula:

100,000 is value of a standard contract size.

If you have an option to choose your Broker Leverage, always ask for the highest leverage your broker can offer. Beware if you trade non USD base currency because your margin level will change all the time according to the market value of your base currency to the USD. I will tell you why with this example.

You open an account with USD 8,000 and you get 1:500 leverage from your broker. You buy 2 standard lots and 3 mini lots GBP/JPY at 158.500 and the price of GBP/USD at that time is 1.6000. What is your margin level that needs to be maintained at the time you purchased?

Total Open Positions = 2 standard lots and 3 mini lots = 2.3

Then margin level = Total Open Positions x 100,000 x Leverage offered x Base Currency Value to USD.

Margin level = 2.3 x 100,000 x (1:500) x 1.6000

Margin level = 736 USD

If the next day the price of GBP/USD becomes 1.65000; then the margin level that you need to maintain is:

Margin level = 2.3 x 100,000 x (1:500) x 1.65000

Margin level = 759 USD

That’s why you need to be aware that margin level is change all the time according to the market value of your base currency to the USD.

What happened if you open an account and get 1:50 leverage?

Margin level = 2.3 x 100,000 x (1:50) x 1.60000

Margin level = 7,360 USD

You only have spare money of USD 740 (8000-7360) to hold if the price goes down against your buy positions. It is about 74 pips only (pip value is different among pairs). I will explain later how to calculate pip value in Forex Basic sections. To make the illustration simple, let’s assume GBP/JPY pip value is USD 10 for 1 standard lot; therefore you will get 74 pips from USD 740 / 10 USD.

Let’s compare with if you have 1:500 leverage. Your margin level will be USD 759. You have spare money of USD 7,241 (8000-759) or about 724 pips to hold your positions if the price goes against you. Therefore you have more money to maintain your position.

Margin level does no effect with your profit or loss! Regardless of the Broker Leverage you get, the pip value will always be the same. If you take profit for 100 pips, then you will get USD 1000 (USD10 pip value x 100 pips gain); it will be the same value if you take a 100 pip loss; you will lose USD 1000. But the most important difference is with 1:500 you have extra USD 7,241 to hold your positions and with 1:50 you only have USD 759. With the same capital you have more extra cash to maintain your position with higher Broker Leverage (remember leverage is to get more with the same or less effort). The more you have extra cash to maintain your position the better. Therefore, always ask for the highest leverage your broker can offer.

Brokers offer you a very high leverage because they hope you to trade with high leverage. The higher the true leverage you use, the riskier your trade is, the happier your broker will be.

Now, you understand what Broker Leverage is and how to use it favorably for you. Let’s continue to True Leverage.

- True Leverage.

True leverage is the leverage you use when you trade. It is not the same with the leverage that is offered by your broker.

Suppose you open an account and put USD 100,000 and you get 1:500 leverage. The question is if you buy 1 standard lot GBP/USD at price 1.50000, what is your leverage?

If you answer your leverage is 1:1, like most other traders’ answer. You are WRONG. The correct answer is that your leverage (your true leverage) is 1 : 1.5.

If you open your MT4 and drag your mouse from price 0 to price 1.50000, there will be 15,000 pips. Pip value of GBP/USD standard lot is USD 10. Therefore:

Capital that supposed to be used:

= 15,000 x USD 10

= USD 150,000

True leverage = Capital that supposed to be used / Capital you actually use

= USD 150,000 / USD 100,000

= 1.5

Another example: You have USD 100,000 with leverage 1:500; you buy 1 standard lot of AUD/JPY at 65.000. What is your true leverage?

From MT4 you will see that 65.000 equal 6500 pips, and 1 pip value of AUD/JPY is USD 10.9. Therefore:

Capital that supposed to be used:

= 6,500 x USD 10.9

= USD 70,850

True leverage = Capital that supposed to be used / Capital you actually use

= USD 70,850 / USD 100,000

= 0.7

You suppose only need capital of USD 70,850 to buy 1 lot AUD/JPY at that price; therefore you have extra cash of USD 29,150 that has no use.

If you open an account with USD 70,850 and buy 1 lot AUD/JPY at that price, your true leverage is 1:1.

You see from these examples that your Broker Leverage has nothing to do with your true leverage.

Let’s continue with AUD/JPY example. You buy 1 more lot at 75.000.

Capital that supposed to be used to buy 1 lot at 75.000 =

= 7,500 x USD 10.9

= USD 81,750

True leverage = Total Capital that supposed to be used / Total Capital you actually use

= (USD 70,850 + USD 81,750) / USD 100,000

= 1.5

Simple method to convert price into pips:

For 5 digits price behind comma (non JPY cross); multiply the price with 10,000

For 3 digits price behind comma (JPY cross); multiply the price with 100

Example:

GBP/USD @ 1.54321 = 15,432 pips

AUD/JPY @ 65.222 = 6,522 pips

- Proper Leverage.

Proper leverage is the true leverage that you use at specific level which is relatively safe (next to impossible to be hit). Proper leverage is strongly interconnected with stop loss (I will explain later this relationship in the risk-reward-probability section).

Each trader has a different proper leverage due to his tolerance to risk.

I hope this analogy will help. If you listen to music, you have the choice to set the volume low, loud, or very loud. Your volume preference is different from me and the others. But if you pump the volume loud, your ears or your equipment can be damaged instantly or it may take sometimes for your ears to be damaged. For short term you may not realize that your listening capability has been deteriorate, until suddenly you can barely hear anything. If you play the music too soft, you can not enjoy it fully. You can not hear the background music, etc. You must set the volume to match your preference and your comfort zone, but never too loud.

This analogy is the same with trading. I like to repeat the whenry’s law of trading leverage again that:

Every trading system that uses leverage, no matter how low or how high the leverage is bound to lose money soon or later, either some or all of your capital. This is the fact; you can not run from it. The only way not to lose money is not to use any leverage and stop loss at all.

You can use no leverage or very little average so that your risk is minimal or none, but your return will be low also. The higher the leverage you set, the higher the return you get and the higher the risk you face. The most important thing is how to set your proper leverage in your comfort zone, manage risk-reward-probability and maximize your return.

Stop Loss / Cut Loss

Why do you use Stop Loss? Why do you put your Stop Loss there? Most traders will answer “to stop further loss and because my system requires risking only 1% of my capital per trade”. If this is also your answer, you really need to think again and change your perspective about Stop Loss. Think deeply, why do you use Stop Loss? Why do you put your Stop Loss on that level? Do you know that stop loss is not guaranteed to be executed? And the most important thing, do you really need Stop Loss?

Trading Forex is different from trading individual stock. The value of individual stock can go to zero if the company goes bankrupt, but the value of a currency can not go to zero. This is why you use no Stop Loss and no leverage. But, the problem is if you use no leverage at all, your return will be small. If your risk tolerance is high enough, you can use leverage properly. Your proper leverage will automatically become your Stop Loss.

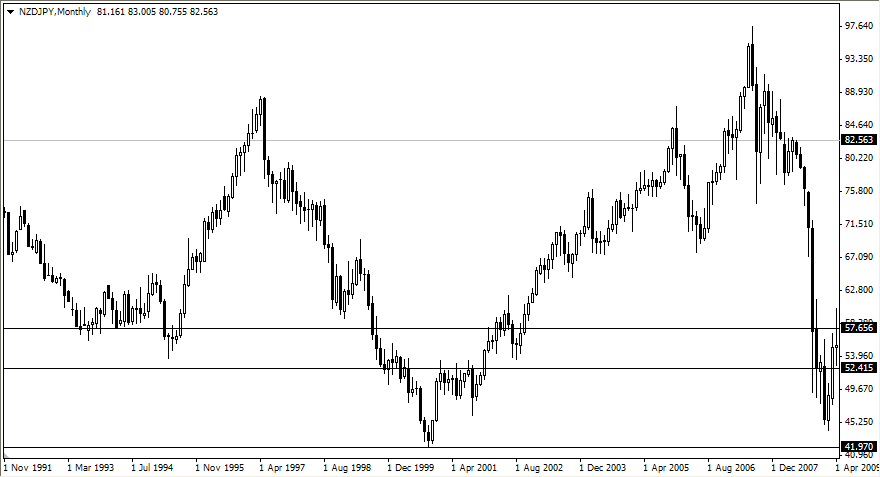

Example: Assume today is in October 2008, you browsed currencies pairs to seek for trading opportunities. You look at NZD/JPY and saw an opportunity; the price had drop so much; it is a very high probability that the price will go up. The price is 52.415 and you decide to buy 1 standard lot without leverage; therefore you deposit $52,415. You are not a greedy person; you just want to make 10% return of it; so you set your Target Profit at 57.656 (524 pips).

5 months later your Target Profit reached. You make $5,241 in 5 months. Not bad at all. Most traders and companies will struggle just to make 10% ROI a year.

Since you are a smart trader; you read hundreds of Trading Forex books, you study economic; therefore you know that currencies tend to move inside a certain range because the value of currency can not be too low or too high so that it will affect the economic of that country; and you know how to take a calculated risk by using proper leverage, therefore you want more return.

But, unfortunately your risk tolerance is very low. You don’t want your leverage to be higher than 1:2. So, instead of using $52,415 to buy 1 standard lot, you only deposit half of it, $26,207.5. Your Target Profit reached and you gained $5,241, 20% return. It is a very good result. You have doubled your return by just tweaking your leverage and stay safe.

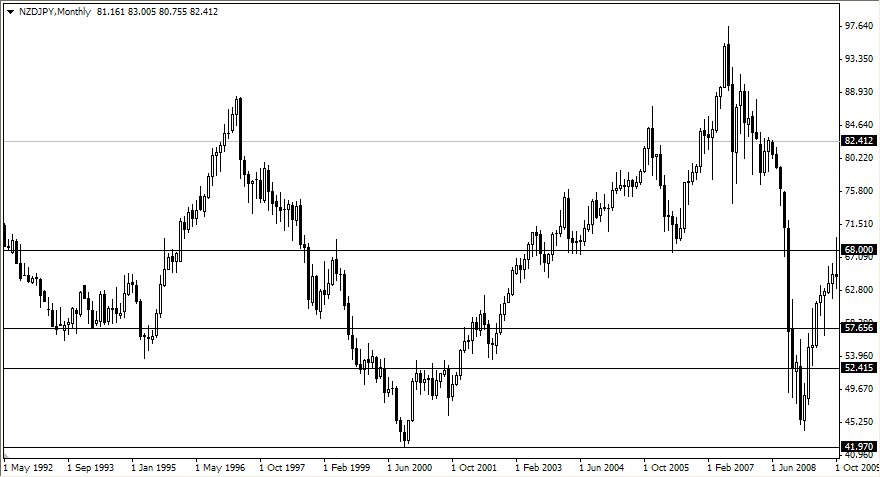

You become greedier. You think how you can maximize your return but still stay safe. You look at the chart and see that the lowest price in history of NZD/JPY is 41.970. You said to yourself, “How about to put my Stop Loss below that level where it is next to impossible to be taken”, and “How about if I put my Stop Loss at 31.970; it is a 1,000 pips buffer below the lowest price, and it is a very safe buffer”. So, you put $20,445 as your deposit. Your true leverage will be 1:2.56 (2.56 = $52,415 : $20,445). Your return will be 2.56 x higher; your return will be 25.6%.

You notice that your Target Profit is too low. You think that if you set your target at 68.000 around major resistance is quite possible and achievable.

You will gain $15,585. If you use leverage of 1:2.56, your return will be 76% ($15,585 : $20,445)

This is how you use proper leverage, by putting your Stop Loss at next to impossible level where probability of your Stop Loss being taken is zero or very low.

In summary:

- There are three kinds of leverages:

- Broker leverage – you always ask for the highest leverage your broker can offer.

- True leverage – the actual leverage you use when you trade.

- Proper leverage – the leverage you should use to maximize your return and stay safe.

- Stop loss is not guaranteed to be executed.

- In a very thin market (SNB 2015-01-15) stop loss can not save you, not even margin call. You can ended up with negative balance.

- You do not need Stop Loss in Forex because the value of a currency can not go to zero, unlike individual stocks.

- You do not need stop loss if you use low leverage.

- You will need a stop loss if you use high leverage.

- Your proper leverage level becomes your stop loss level. You need to set your proper leverage or stop loss level at a place where it is next to impossible to be hit. Other than this place, you do not need another stop loss.